Do you know why biometric verification has become essential across industries? In many organizations, practices like buddy punching, where employees clock in for others, have become a common issue. Fake profiles, stolen logins, fake IDs—it is all part of the daily mess businesses deal with. Every click, every signup, and every transaction is a potential opening for fraud.

In such cases, biometric attendance tracking has emerged as the most reliable solution—and that’s exactly why “identity assurance” has become such a big deal. It acts as the layer of trust between people and the platforms they use, shifting away from traditional paperwork toward advanced technology. Today, banks, retailers, and even governments are rethinking how they verify individuals, relying more on biometrics, AI, and real-time data to confirm that the person behind the screen is truly authentic.

From Simple Checks To Biometrics

There was a time when verifying someone meant matching an ID to a name and moving on. That model barely holds up anymore, because information that once proved identity – an address, a Social Security number, a date of birth – is exactly what criminals trade on the dark and deep web.

Companies started looking at something more difficult to fake: behavior. How someone moves through a website, what device they use, how they type, and how often they log in. These things form a digital fingerprint, a profile that changes but stays uniquely tied to that person.

Identity assurance has evolved from “Does this information match?” to “Does this make sense?” It is a small shift in question – but a massive leap in accuracy.

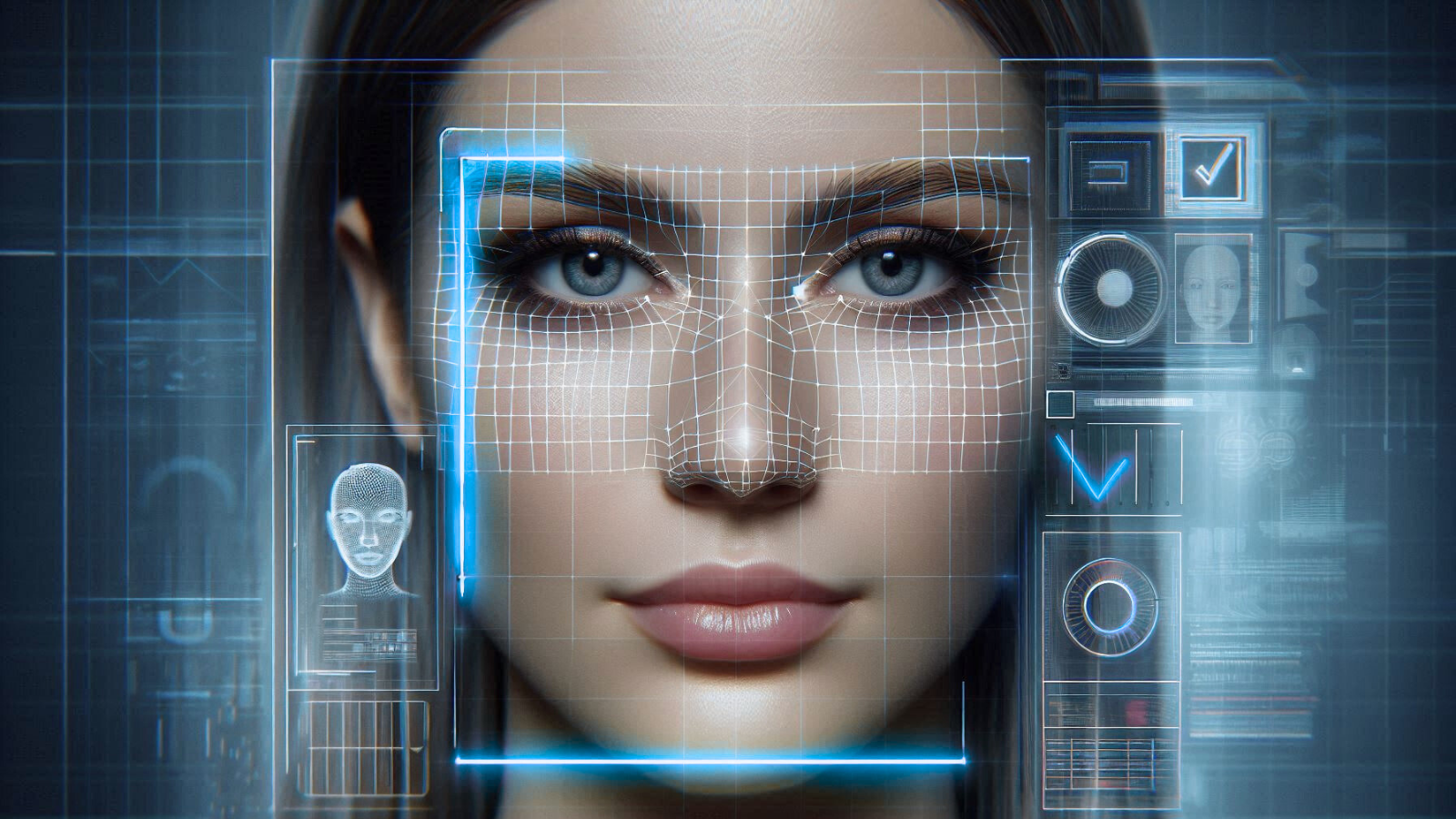

Biometrics And The Human Element

Biometrics are the bridge between physical and digital identity. They do not just confirm information; they confirm existence.

The technology has quietly become part of everyday life: unlocking phones with a fingerprint, sometimes even paying for coffee with a face scan, boarding planes with various checks, and much more. It feels routine now, but behind that convenience is one of the most powerful fraud-prevention tools available.

The real value of biometrics is not just security – it is certainty. A fingerprint can not be guessed. A voice pattern can not be stolen. If these tools are used correctly, these systems cut through the noise of fake accounts and false claims.

Some of the most common types include:

- Facial recognition – fast, intuitive, and now trained to detect deepfakes.

- Fingerprint scans – still the most widely adopted and cost-effective biometric.

- Voice ID – growing in use for call-based and remote verification.

- Behavioral biometrics – the subtle cues in how you type, swipe, or hold a phone.

Of course, all of this depends on trust. Storing raw biometric data is risky, so the best systems never keep it in its original form – they convert it into encrypted templates that can not be reused. When done responsibly, biometrics make online identity feel a little more human again.

AI Is The New Fraud Detective

Artificial intelligence does not just automate checks; it thinks in patterns. It connects details that humans can not see in time – the kind of micro-anomalies that hint something is off.

AI runs in the background of almost every modern identity verification software solution. It looks at images, timestamps, devices, and behaviors, and then compares them against thousands of previous cases – that is how it catches things like forged documents, mismatched selfies, or inconsistencies in metadata.

And because AI learns, it gets sharper with each attempt to fool it. Fraudsters tweak their methods. The algorithms adjust. It is an ongoing chess match – and one where the machine rarely forgets a move.

The best part is that users barely notice it is there. EmpMonitor enhances this by combining AI-driven monitoring with face recognition to prevent fraudulent logins and ensure only verified users gain access. The process feels instant, but under the hood, millions of calculations are working to make sure you are who you claim to be.

The Data That Holds It All Together

For all the talk about AI and biometrics, what really powers identity assurance is data – reliable, connected data.

Banks, payment providers, and marketplaces now piece together information from multiple layers:

- Device history – whether a phone or laptop has been linked to past fraud.

- Network behavior – patterns in IP addresses, VPN usage, or unusual geolocation jumps.

- Account activity – transaction habits, spending behavior, or timing that does not fit the user’s normal rhythm.

- Cross-industry signals – shared intelligence that spots repeat offenders across platforms.

It is not about surveillance; it is about context. The more context a system has, the more fairly it can judge what is happening. That is how companies reduce false alarms and stay alert to real threats.

Making Security Feel Invisible

Although nobody wants to feel interrogated just to open a bank account or sign up for an app, that is where good design can have smart tech.

Modern identity assurance works quietly. Most of the time, you do not see it. Systems analyze in the background, validating who you are while you move through the process. If something looks wrong – a strange login, a new device – the system steps in and asks for more proof.

This kind of adaptive friction makes the process smoother for real users and tougher for impostors. It is the difference between locking everyone out and letting the right people in safely.

Fighting Fraud Together

One thing fraudsters are good at? Sharing information. Once a tactic works, it spreads. That is why industries are finally starting to fight back in the same way – by collaborating.

Banks, regulators, and fintech companies are building shared databases and networks that flag unusual activity without exposing personal details. When one organization spots a pattern, others can prepare for it.

A few key benefits of these partnerships:

- Fraud gets detected earlier.

- High-risk behavior is spotted across multiple platforms.

- Compliance costs go down when intelligence is shared.

- Customers move between verified platforms more safely.

Fraud prevention used to be a solo effort. Now, it is becoming a team sport – and the technology makes that teamwork practical at scale.

Keeping It Ethical

Every time technology gets better at identifying people, it also raises tough questions about privacy. How much is too much? Who is responsible when algorithms make mistakes?

Trust in identity systems depends on transparency, because users deserve to know how their data is handled, what is being collected, and why, and for example, regulations like GDPR and newer AI laws are forcing companies to think harder about fairness, consent, and explainability – which is exactly what the industry needs.

In the end, the goal isn’t just catching fraud. It’s doing it in a way that keeps users’ confidence intact.

What The Future Looks Like?

Identity assurance is only getting smarter. Instead of static checks, systems are moving toward constant, invisible monitoring – verifying identity continuously, not just once at signup.

Biometrics will blend with behavioral data. AI will predict risks before they happen. And instead of separate tools for KYC, fraud detection, and access management, we will see unified systems that make identity verification part of the everyday user experience.

The real future is about better use of it. The winners will be those who know how to have automation with empathy: making fast decisions, building fair systems, and ensuring simple transparency.

Conclusion

Identity assurance is not about paranoia. It is about confidence – knowing that behind every click, there is a real person, and behind every protection, there is respect for that person’s privacy.

Biometrics, AI, and data-driven systems are shaping how trust works online, and when it is used well, they do not make things complicated; they make them safer, faster, and more human.

Because the truth is, technology does not replace trust – it helps earn it.