Managing payroll can often feel overwhelming, especially for small and mid-sized businesses that don’t have a dedicated HR department. Every payday comes with the responsibility of ensuring that employees are paid correctly, taxes are calculated accurately, and records are maintained in compliance with labor laws. This is where a pay stub template becomes a real game-changer.

A stub template is essentially a pre-formatted document that helps businesses create consistent and professional pay stubs without having to start from scratch each time. Instead of juggling spreadsheets and manual calculations, companies can rely on a ready-made structure that includes all the necessary details: gross pay, deductions, benefits, and net income.

The best part? You don’t need to be a payroll expert to use one. With the right pay stub template, employers can save time, reduce human errors, and give employees clear visibility into how their earnings are calculated. For employees, receiving a professional and accurate pay stub builds trust and ensures transparency in the workplace.

In this guide, we’ll cover everything you need to know about what a stub template is, why it’s important, the different types available, and even how to create one yourself. By the end, you’ll have a comprehensive roadmap for selecting or designing a stub template that best suits your business needs.

You can also listen to our podcast here,

What Is a Pay Stub Template?

At its core, a pay stub template is a structured format that employers use to create professional pay stubs for their employees. Instead of designing a new document from scratch every payday, businesses can rely on a pre-designed template that already has all the necessary fields built in. This helps you work faster and makes fewer mistakes.

A pay stub, sometimes called a paycheck stub, is essentially a breakdown of an employee’s earnings and deductions during a specific pay period. It shows details like:

- Employee Information – Name, employee ID, and pay period dates.

- Earnings – Regular hours, overtime, bonuses, and gross pay.

- Deductions – Taxes, insurance, retirement contributions, or other withholdings.

- Net Pay – The actual amount an employee takes home after deductions.

A stub template makes sure all these sections are consistently included, so nothing gets overlooked. Templates can come in many formats, such as PDF, Word, or even a stub template Excel version for those who like automated calculations.

Another advantage of using a template is flexibility. For example, an editable free stub template allows businesses to customize the layout with their company logo, branding colors, or additional fields specific to their industry. Meanwhile, small businesses looking for a simple solution often prefer a free stub template with calculator, which can do the math automatically without needing advanced payroll software.

In short, a pay stub template isn’t just a document; it’s a tool that ensures professionalism, accuracy, and efficiency in payroll management.

Why Businesses Need a Pay Stub Template?

Running payroll is one of the most important responsibilities for any business, but it’s also one of the most time-consuming and error-prone tasks. A single mistake in calculating earnings, taxes, or deductions can lead to employee dissatisfaction, legal issues, and even penalties. This is where using a pay stub template makes a big difference.

Here’s why every business, from startups to established enterprises, should rely on one:

1. Accuracy in Payroll

A stub template ensures that all necessary fields, such as gross pay, deductions, and net pay, are included. This reduces the chance of missing important details or making manual errors, which can cause payroll disputes.

2. Transparency for Employees

Employees appreciate clarity. With a standardized stub template, they can easily see how their wages were calculated, what deductions were taken, and what their final take-home pay is. This builds trust between employers and staff.

3. Compliance with Legal Requirements

In many regions, providing detailed pay stubs isn’t optional; it’s a legal requirement. A proper template ensures your business stays compliant with labor laws and tax reporting standards.

4. Time-Saving for Employers

Instead of creating a new layout every payday, employers can simply reuse a pay stub template, saving hours of administrative work. This is especially valuable for small businesses that don’t have a full HR team.

5. Professionalism and Recordkeeping

Using a template gives your payroll documents a polished look while keeping all records consistent and easy to store. This makes audits and financial reviews much smoother.

In short, a stub template is more than just a convenience; it’s a tool for accuracy, compliance, and trust-building in any workplace.

Types of Pay Stub Templates

Not all businesses have the same payroll needs, which is why there are different kinds of stub template options available. Choosing the right one depends on factors like company size, payroll complexity, and the level of customization you want. Here are the most common types:

1. Free Pay Stub Template

A free stub template is the simplest option. It’s ready to use and often comes in PDF or Word format. Small businesses or freelancers who need a quick solution can benefit from this version. It includes the basic fields for employee details, income, deductions, and net pay without requiring extra setup.

2. Editable Free Pay Stub Template

An editable free stub template allows for customization. Businesses can add their logos, adjust formatting, or include extra fields such as overtime, bonuses, or department codes. This is perfect for companies that want their pay stubs to reflect a professional brand image while maintaining flexibility.

3. Pay Stub Template Excel

A stub template Excel version is ideal for businesses that want built-in formulas to handle calculations automatically. Employers can simply input hours worked, tax rates, and deductions, and the template will calculate the totals. This makes payroll faster and minimizes errors.

4. Free Pay Stub Template with Calculator

A free stub template with calculator is great for those who want accuracy without doing the math themselves. It usually comes as a digital file where deductions and net pay are calculated automatically once income data is entered.

Each type of pay stub template has its own advantages. While free templates work well for startups and freelancers, editable and Excel versions are better for businesses that need flexibility and automation.

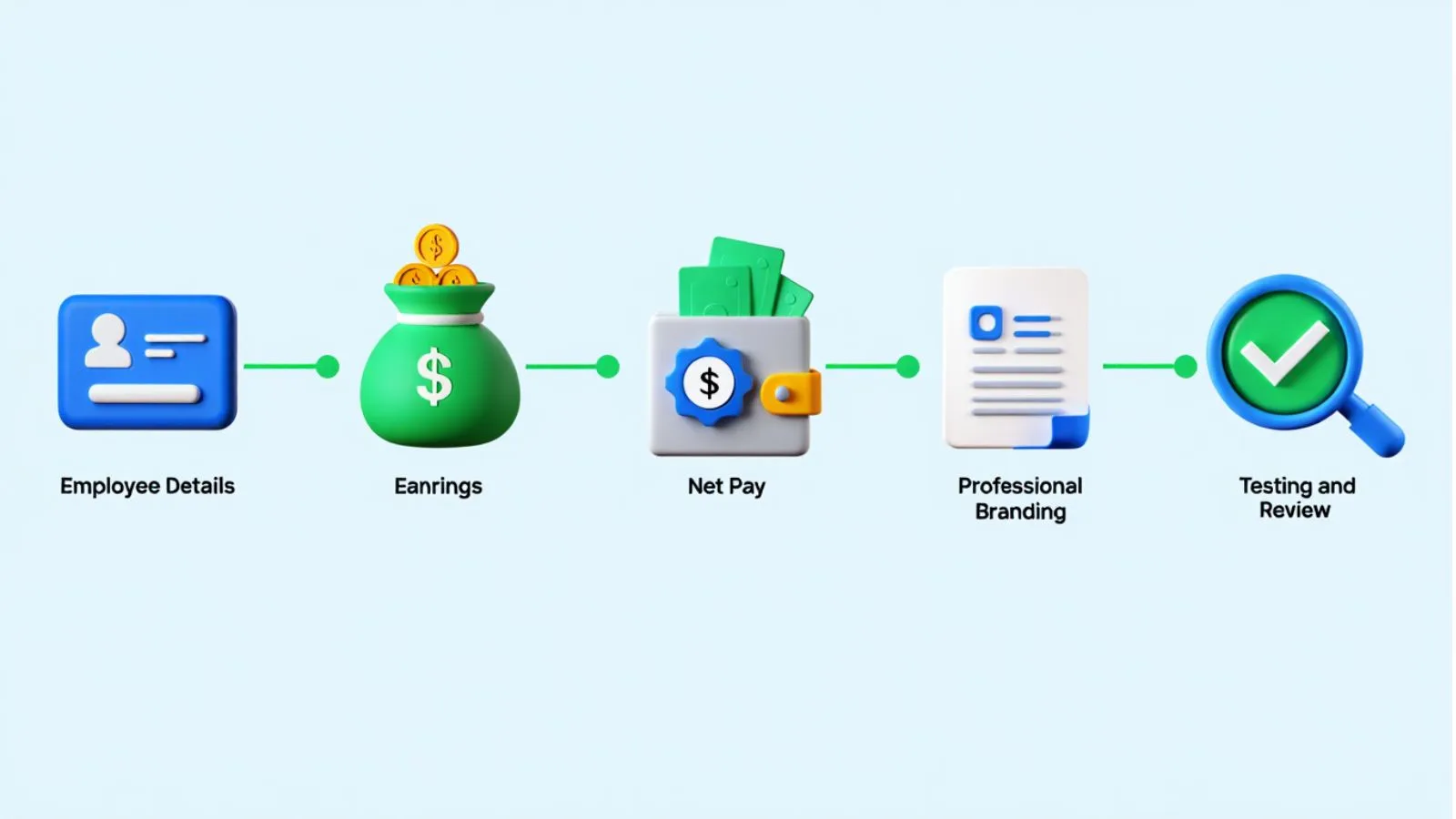

How To Make A Pay Stub Template?

While there are plenty of ready-to-use options available, some businesses prefer designing their own stub template to better match their payroll needs. Creating one isn’t as complicated as it might sound. Here’s a simple step-by-step process:

1. Gather Employee Details

Start with the basics—employee name, address, employee ID, and pay period dates. This information ensures the pay stub is personalized and clearly linked to each worker.

2. Add Earnings Information

Include regular working hours, hourly rate, overtime pay, bonuses, or commissions. These details are essential for calculating gross income.

3. List Deductions and Contributions

Every pay stub template should outline deductions clearly. Common examples include federal and state taxes, insurance premiums, social security, and retirement plan contributions. This transparency avoids confusion for employees.

4. Show Net Pay

The most important section is net pay—the amount an employee actually takes home. A stub template Excel version or a free pay stub template with calculator can make this process effortless by auto-calculating the final figure.

5. Keep It Professional

Add your company name, contact information, and even branding elements like a logo. An editable free stub template gives you the flexibility to customize layouts so the final document looks polished and official.

6. Test and Review

Before using your new stub template across the company, test it with sample data to ensure calculations are accurate. A quick review can help you catch errors early.

By following these steps, you can create a pay stub template that not only looks professional but also provides employees with a clear, reliable record of their earnings.

Benefits of Using a Pay Stub Template

Relying on a stub template can save businesses a lot of headaches. Beyond just providing a professional-looking document, templates offer several real-world benefits that make payroll management faster, easier, and more accurate.

-

Time-Saving

Creating a pay stub from scratch for every employee takes valuable time. A pay stub template removes repetitive work by offering a ready-made structure. Employers simply need to fill in employee details and earnings, which cuts down payroll processing time significantly. Using a timecard template alongside a pay stub template can further streamline the process by accurately recording employee work hours for payroll calculation. -

Reduces Errors

Payroll mistakes are costly and can damage employee trust. A structured stub template ensures no important fields are missed, and when combined with tools like a stub template Excel or a free pay stub template with calculator, it can also automate calculations, lowering the chances of human error. -

Professional Appearance

Employees are more confident when they receive clean, well-formatted pay stubs. An editable free stub template allows businesses to add branding elements like logos, making pay stubs look official and trustworthy. -

Compliance Made Easier

In many regions, labor laws require employers to provide detailed earnings and deduction breakdowns. A pay stub template ensures compliance by consistently including all the necessary information. -

Supports Workforce Management

When integrated with tools like workforce management software or workforce monitoring software, templates become even more powerful. Businesses can seamlessly track employee hours, productivity, and payroll records all in one place. This combination creates a smoother HR workflow and reduces the risk of disputes.

In short, using a stub template is not just about convenience; it’s about building accuracy, trust, and efficiency into your payroll system.

Free & Editable Pay Stub Templates: Which One Should You Choose?

With so many options available, it’s natural to wonder which stub template is the best fit for your business. The answer depends on your specific needs, the size of your team, and the level of customization you want. Let’s break down the choices:

Free Pay Stub Template

If you’re running a small business or freelancing, a free pay stub template can be the easiest option. It covers the essentials of employee details, earnings, deductions, and net pay. This type of template works well for straightforward payroll situations without extra requirements.

Editable Free Pay Stub Template

For businesses that care about branding and flexibility, an editable free stub template is a smart choice. It allows you to include your company logo, adjust the design, and even add custom fields like project codes or expense reimbursements. This option ensures your pay stubs look polished and consistent with your company’s identity.

Pay Stub Template Excel

A pay stub template excel format is best if you want automation. With formulas built in, Excel can handle tax and deduction calculations automatically. This saves time and reduces the risk of manual mistakes, especially if you’re managing payroll for multiple employees.

Free Pay Stub Template with Calculator

For those who don’t want to deal with complex formulas, a free stub template with calculator is perfect. It automatically calculates deductions and net pay once you enter the gross income, making payroll quick and stress-free.

In short, the type of stub template you choose depends on how simple or advanced your payroll process needs to be. For most small businesses, free or Excel-based templates provide the ideal balance of ease and efficiency.

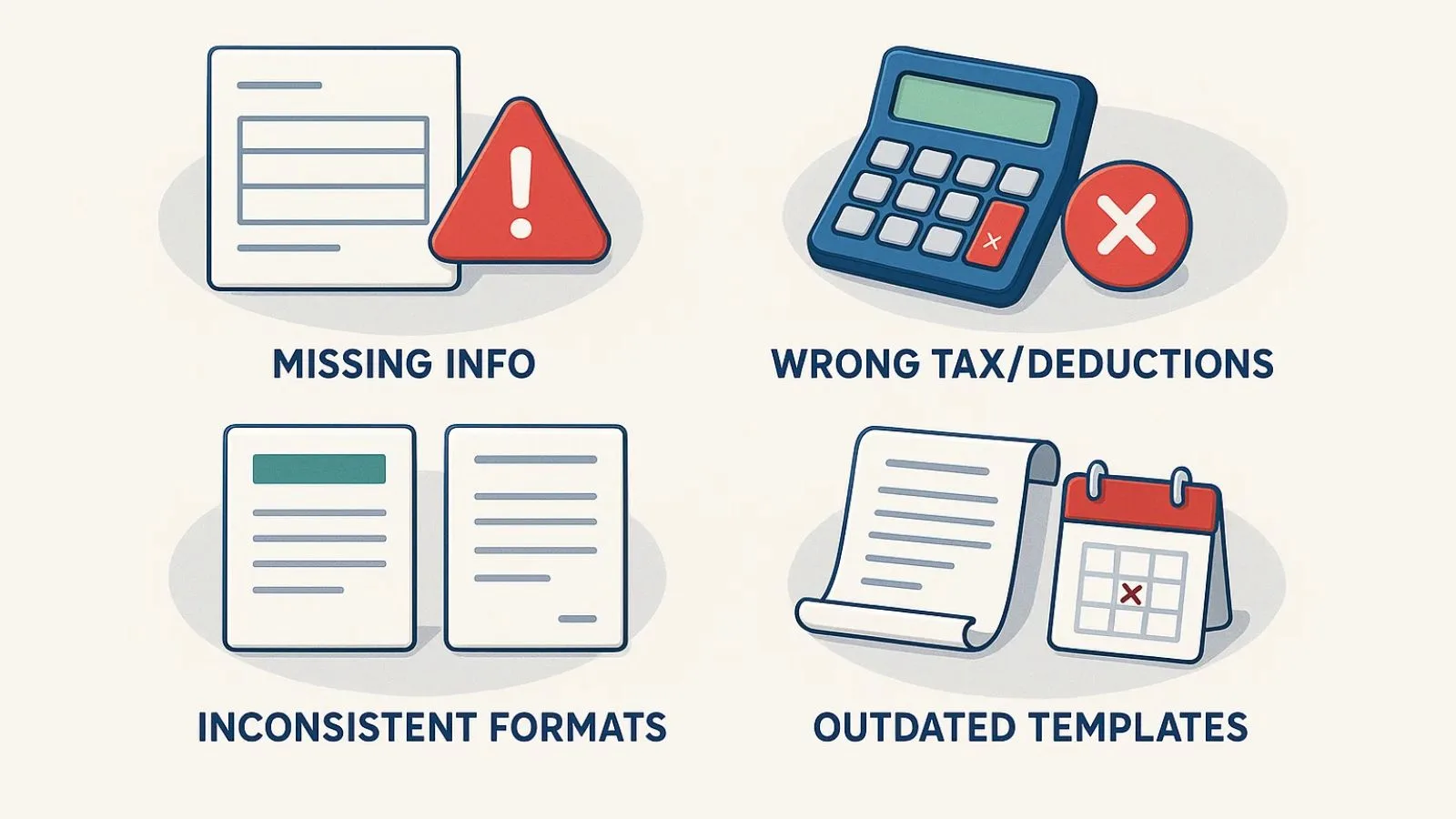

Common Mistakes to Avoid in a Pay Stub Template

Using a stub template makes payroll easier, but small mistakes can create big problems for both employers and employees. Here are some common errors you should avoid:

Missing Key Information

A pay stub must always include employee details, pay period, gross pay, deductions, and net pay. Leaving out even one of these makes the stub incomplete and unprofessional.

Incorrect Tax or Deduction Calculations

One of the biggest mistakes is miscalculating taxes or benefits. If you’re not careful, employees may be underpaid or overpaid, leading to compliance issues. That’s why using a pay stub template Excel or one with a calculator is highly recommended.

Lack of Consistency

Switching between different formats or designs can confuse employees. Stick to a standard template so your pay stubs look uniform and official.

Not Updating Templates

Tax laws and deduction rules change over time. If you’re using an outdated stub template, you risk errors and non-compliance. Always update your templates regularly.

By avoiding these mistakes, businesses can ensure that every pay stub template remains accurate, compliant, and professional.

Also read,

Discover The Best Employee Hours Tracker For Small Business

How Can A Time Card Template Boost Productivity?

How EmpMonitor Simplifies Payroll and Workforce Management?

While using a pay stub template can save time, many businesses eventually need a smarter solution to handle payroll and employee tracking together. That’s where EmpMonitor comes in.

EmpMonitor isn’t just about monitoring—it’s a complete workforce management software designed to make employee administration easier. Along with productivity tracking, attendance monitoring, and scheduling, it also supports payroll-related tasks. By integrating timesheets with pay records, businesses can generate accurate data for pay stubs without manual effort.

Instead of juggling multiple tools, EmpMonitor provides everything in one place. For example:

- Automated Attendance Data – Reduces errors when creating stubs from a pay stub template.

- Real-Time Activity Tracking – Ensures employees are compensated fairly based on actual working hours.

- Centralized Records – Keeps payroll, attendance, and workforce reports in sync.

For small businesses still using a free pay stub template, EmpMonitor helps bridge the gap between manual templates and a fully automated system. It ensures accuracy, compliance, and efficiency, while giving employers complete visibility into their team’s performance.

With tools like EmpMonitor, payroll is no longer just about creating pay stubs—it becomes part of a smarter, data-driven workforce strategy.

Final Thoughts

A pay stub template is more than just a payroll document—it’s proof of transparency and professionalism. For employees, it builds trust by showing how earnings and deductions are calculated. For employers, it ensures compliance and consistency while saving time.

From using a free stub template to customizing with Excel or calculators, businesses have plenty of options to get started. The key is choosing a format that’s accurate, easy to use, and keeps up with legal requirements. Avoiding common mistakes like missing information or outdated templates will also go a long way in keeping payroll stress-free.

However, as your team grows, relying only on a stub template may not be enough. That’s when workforce solutions like EmpMonitor come into play. By combining payroll-related data with attendance and productivity tracking, EmpMonitor ensures payroll is not only accurate but also efficient and automated.

In short, a well-structured pay stub—backed by the right tools—can make payroll simpler, more reliable, and more professional for every business.

FAQs

1. What is a pay stub template?

A pay template is a ready-made document that records employee earnings, deductions, and net pay. It helps businesses generate professional pay stubs quickly without creating them from scratch.

2. Can I use a free pay stub template for my small business?

Yes! A free stub template is perfect for freelancers or small businesses. It ensures employees get clear records of their pay while saving you time and money. For extra features like automated calculations, you can also use a free stub template with calculator.

3. How do I make a pay stub template more accurate?

To make a pay stub template accurate, always include employee details, pay period, gross pay, deductions, and net pay. Using a pay stub template Excel or an editable version helps automate calculations and reduce errors.