Case Study

Fortifying NBFCs Against Insider threats

Fortifying NBFCs Against Insider threats

Non-Banking Financial Companies (NBFCs) play a crucial role in providing loan financing and other financial services, contributing to the economic growth of many nations.

Overview At A Glance

As digital transformation becomes central to their operations, these institutions face an increased risk of data breaches, especially from insider threats. Protecting sensitive customer data and financial information is critical to maintaining trust and complying with regulatory requirements.

One of our clients, a leading NBFC, approached us with a pressing concern: securing internal data from insider threats, particularly during periods of vulnerability such as when employees were serving their notice period.

Challenges in Safeguarding Sensitive Financial Data

The Client faced several challenges concerning insider threats and internal data safety, especially

when employees were transitioning out of the company.

Here’s a breakdown of the key concerns:

Strategic Solutions for Mitigating Insider Threats

To address these challenges, the client turned to EmpMonitor, a workforce monitoring tool that provided robust insider threat prevention solutions. Here’s how EmpMonitor helped safeguard internal data and prevent breaches

Real-Time Monitoring for Immediate Threat Detection

EmpMonitor’s real-time activity tracking gave managers instant visibility into how employees were interacting with sensitive financial data. This allowed for immediate detection of any suspicious activities, especially during critical periods like notice periods.

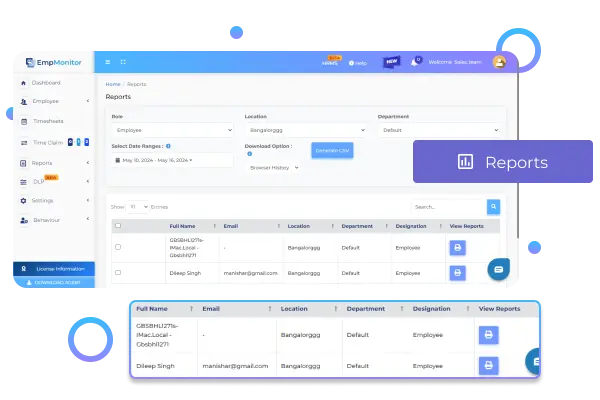

Detailed Reports on Data Access and Usage

EmpMonitor generated comprehensive reports that detailed when and how employees accessed key financial information, including loan applications, customer databases, and internal documents. This reporting provided full transparency and made it easier to spot irregularities.

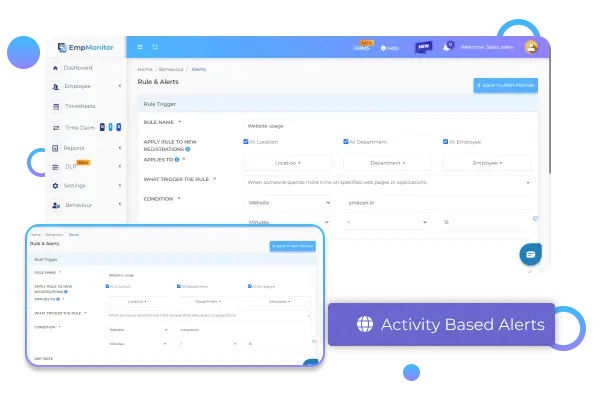

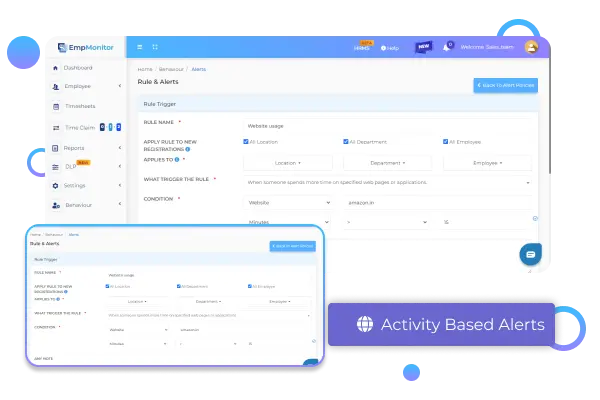

Proactive Alerts for Unusual Activity

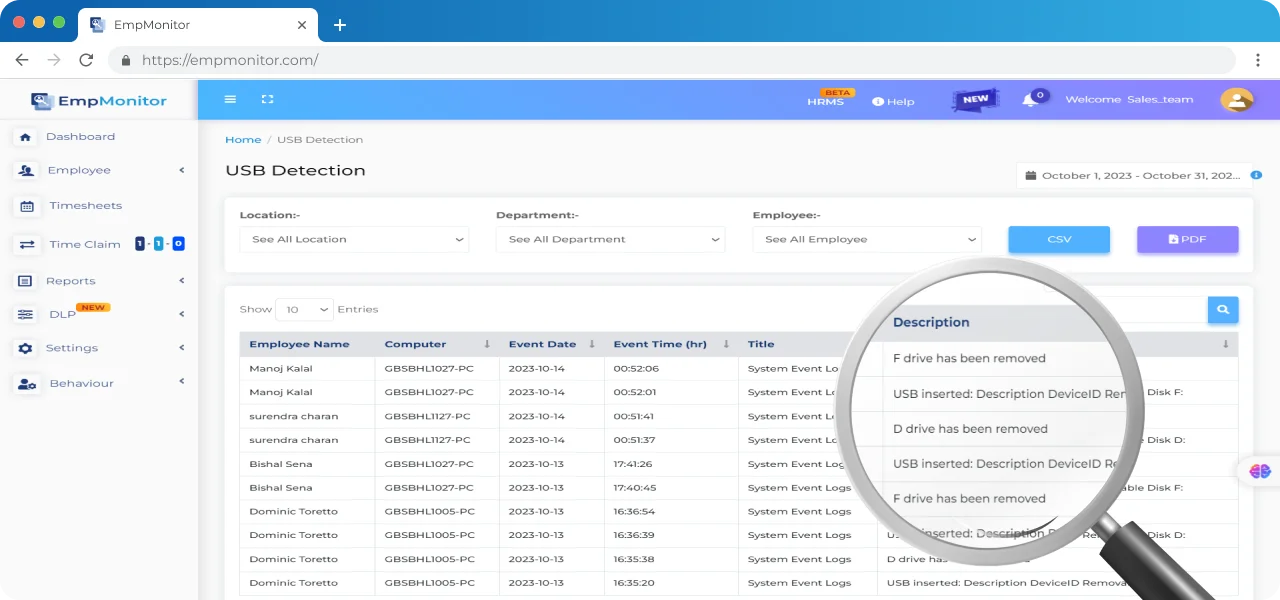

The system’s advanced alert mechanism flagged unusual activity, such as attempts to access restricted files or download large volumes of data. This allowed managers to respond proactively before any real damage was done.

Restricted Access Control During Notice Period

For employees in their notice period, access to sensitive data was restricted based on their role and responsibilities. EmpMonitor allowed the NBFC to implement tighter access controls, reducing the risk of unauthorized data transfers or breaches.

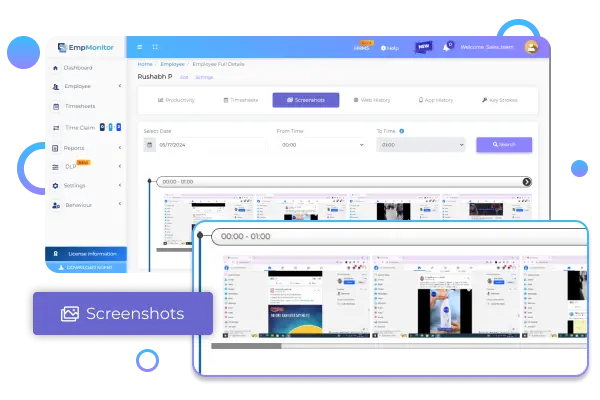

Screenshot Monitoring for Enhanced Visibility

Periodic screenshots provided insights into employees’ desktops, revealing any unusual behaviors such as transferring data to external devices or attempting to share information via unauthorized channels.

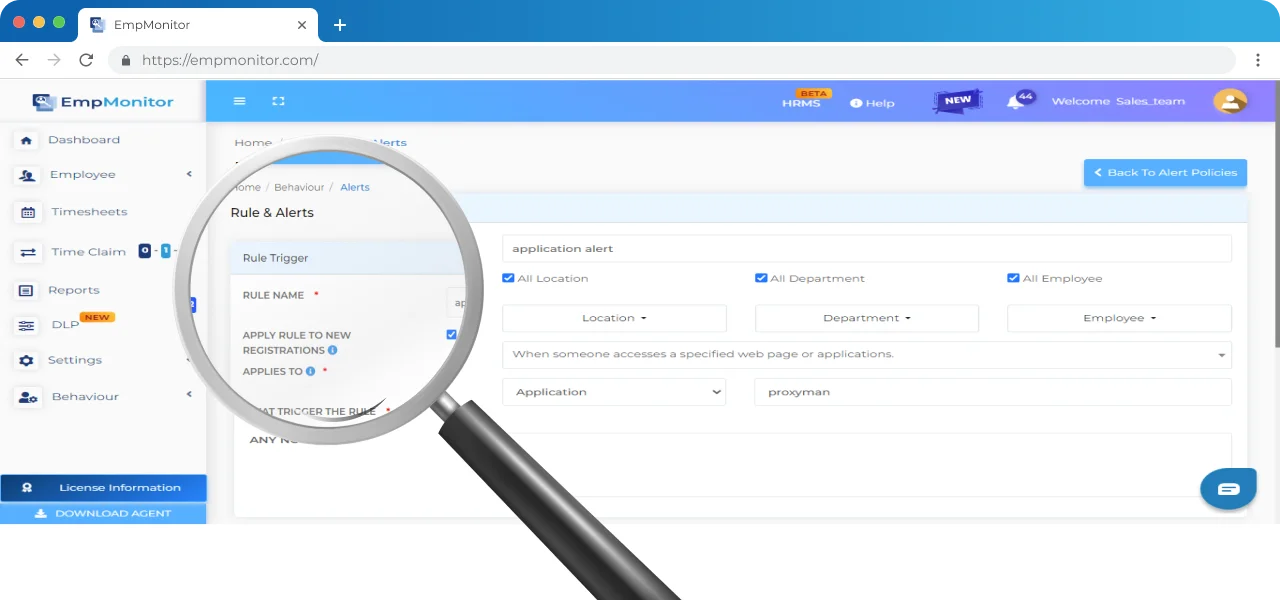

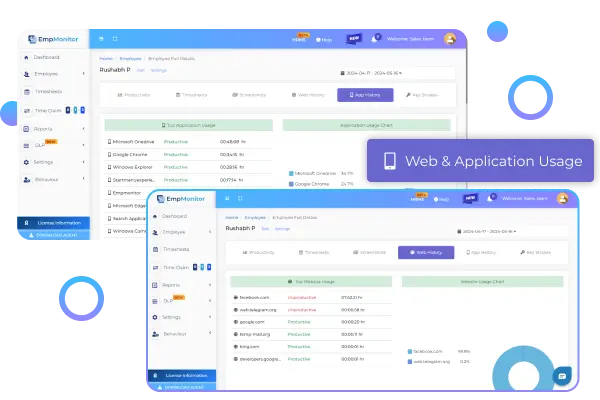

Web and Application Usage Tracking

EmpMonitor tracked which websites and applications were being accessed by employees. This feature allowed the NBFC to ensure that employees were not using unsecured or unauthorized platforms to handle sensitive data.

Compliance and Data Protection

The platform supported the NBFC in complying with stringent financial data protection regulations. By closely monitoring employee activities and access points, EmpMonitor helped the company meet its regulatory obligations and avoid fines or penalties related to data breaches.

Strategic Solutions for Mitigating Insider Threats

To address these challenges, the client turned to EmpMonitor, a workforce monitoring tool that provided robust insider threat prevention solutions. Here’s how EmpMonitor helped safeguard internal data and prevent breaches

Real-Time Monitoring for Immediate Threat Detection

EmpMonitor’s real-time activity tracking gave managers instant visibility into how employees were interacting with sensitive financial data. This allowed for immediate detection of any suspicious activities, especially during critical periods like notice periods.

Detailed Reports on Data Access and Usage

EmpMonitor generated comprehensive reports that detailed when and how employees accessed key financial information, including loan applications, customer databases, and internal documents. This reporting provided full transparency and made it easier to spot irregularities.

Proactive Alerts for Unusual Activity

The system’s advanced alert mechanism flagged unusual activity, such as attempts to access restricted files or download large volumes of data. This allowed managers to respond proactively before any real damage was done.

Restricted Access Control During Notice Period

For employees in their notice period, access to sensitive data was restricted based on their role and responsibilities. EmpMonitor allowed the NBFC to implement tighter access controls, reducing the risk of unauthorized data transfers or breaches.

Screenshot Monitoring for Enhanced Visibility.

Periodic screenshots provided insights into employees’ desktops, revealing any unusual behaviors such as transferring data to external devices or attempting to share information via unauthorized channels.

Web and Application Usage Tracking.

EmpMonitor tracked which websites and applications were being accessed by employees. This feature allowed the NBFC to ensure that employees were not using unsecured or unauthorized platforms to handle sensitive data.

Compliance and Data Protection.

The platform supported the NBFC in complying with stringent financial data protection regulations. By closely monitoring employee activities and access points, EmpMonitor helped the company meet its regulatory obligations and avoid fines or penalties related to data breaches.

The Positive Shift in Risk Management Practices

The implementation of EmpMonitor had a profound impact on the client’s ability to protect sensitive data from insider threats.

Reduced Data Breach Risk During Notice Periods

By tightening access controls and actively monitoring employees during their notice periods, the company saw reduction in insider-related data breaches.

Improved Data Transparency and Accountability

Detailed reports and real-time monitoring provided full transparency on how data was accessed and used, improving accountability among employees.

Proactive Threat Mitigation

With EmpMonitor’s alert system, the NBFC was able to detect and address potential insider threats before they escalated, reducing the chances of significant data loss.

Enhanced Trust with Clients

The increased protection of loan and customer data helped the NBFC maintain trust with its clients, positioning them as a responsible and secure financial institution.

Compliance and Regulatory Success

EmpMonitor ensured that the NBFC adhered to data protection regulations, allowing them to avoid legal issues while strengthening internal security protocols

Measurable Impact Highlights

Conclusion

By integrating EmpMonitor, the NBFC successfully tackled the growing issue of insider threats, particularly during vulnerable periods such as employee transitions. With robust real-time monitoring, proactive threat alerts, and secure data access controls, the company was able to protect its financial data and maintain a high level of trust with its clients.

The implementation of EmpMonitor not only safeguarded their information but also ensured long-term security and regulatory compliance.