Payroll is one of the most important aspects of running a business. A well-structured pay cycle ensures that your employees are paid on time, every time, and that the process runs smoothly. But what is a pay cycle exactly? Simply put, it’s the specific period during which employees receive their wages, whether weekly, bi-weekly, or monthly.

Understanding the different types of pay cycles is crucial, especially for businesses with both hourly and salaried employees, as each requires different management. A consistent pay cycle not only helps you stay compliant with tax regulations and labor laws but also streamlines invoicing, billing, and timesheet tracking, making your payroll process more efficient and less stressful.

Now, here’s the game-changer: using employee monitoring software can take your payroll management to the next level. By automating tracking and ensuring accurate payments, you’ll eliminate errors that could cost you time and money.

Plus, your employees will appreciate the transparency and consistency, leading to higher satisfaction and fewer headaches for your business. Ready to optimize your pay cycle? Keep reading for expert tips that will revolutionize your payroll process!

Listen To The Podcast Now!

What is a Pay Cycle?

Let’s break it down—what is a pay cycle, and why does it matter? A pay cycle is the set schedule your company follows to pay employees. It defines how often your team gets paid and which working days are included in each paycheck. In simple terms, it’s the rhythm of your payroll system.

So, what are pay cycles in practice? They come in several formats—weekly, bi-weekly, semi-monthly, or monthly. Each type affects how you calculate hours, process overtime, and manage your salary budget. Hourly employees may need more frequent pay cycles, while salaried staff often fit well into monthly ones.

The pay cycle also impacts how gross pay is determined. For hourly workers, it’s based on hours worked in that specific period. And if there’s overtime, it must be tracked and applied correctly according to labor laws.

One more thing—don’t confuse pay cycles with pay dates. The pay cycle ends first, and the pay date comes shortly after. Choosing the right cycle ensures timely payments, legal compliance, and a happier workforce.

What Is Pay Period Hours?

Pay period hours refer to the total number of hours an employee works during a specific pay cycle. It’s the foundation for calculating wages, overtime, and benefits.

For hourly employees, it includes every clock-in and clock-out within the pay period. For salaried workers, it helps track PTO, sick days, and compliance with labor laws. Accurate tracking is crucial, especially when overtime or shift differentials are involved.

For example, in a bi-weekly cycle, a full-time employee typically logs 80 hours. But those extra hours? They count toward overtime pay if they exceed the legal limit. That’s why employers and HR teams closely monitor what is pay period hours.

In short, understanding your pay period hours gives you better control over your paycheck and helps avoid paycheck surprises.

Pay Period Hours vs. Pay Cycle: What’s the Difference?

Though they sound similar, pay period hours and pay cycle serve different purposes in payroll. A pay cycle is the recurring schedule a company follows to pay employees—weekly, bi-weekly, semi-monthly, or monthly. It answers the question: When do employees get paid?

On the other hand, pay period hours refer to the actual number of hours an employee works within that specific cycle. It answers: How many hours did the employee work to earn this paycheck?

For instance, if your pay cycle is bi-weekly, your paycheck comes every other Friday. But what you’re paid depends entirely on your pay period hours during those two weeks. One is a timing system, the other is a measurement of work.

Understanding both is key. While the pay cycle sets your payment frequency, pay period hours directly affect how much you’re paid, especially for hourly and overtime calculations.

Different Types of Pay Cycles in Detail

Before diving into the types, let’s quickly recap what is a pay cycle. It’s the schedule an employer follows to process payroll and pay employees. The cycle impacts everything from paycheck timing to tax withholdings. Choosing the right one isn’t just a back-office task—it shapes employee satisfaction and compliance with labor laws.

Let’s explore the most common types of pay cycles and how they work.

1. Daily Pay Cycle

This method allows employees to get paid every day they work. It’s gaining traction with gig and shift-based roles.

Pros:

- Gives workers instant access to earned wages.

- Helps with personal budgeting and boosts morale.

Cons:

- High admin workload and costs.

- There is a risk of non-compliance if not managed well.

2. Weekly Pay Cycle

This is a favorite in construction, hospitality, and retail.

Pros:

- Matches the workweek, making it easy to track hours.

- Improves employee retention in high-turnover industries.

Cons:

- Increases payroll processing time and costs.

- More complex to manage taxes and benefits frequently.

3. Bi-Weekly Pay Cycle

In a Bi-weekly pay cycle format, employees are paid every two weeks, typically 26 times a year.

Pros:

- Predictable paydays with occasional third checks a month.

- Easy to calculate overtime and paid time off.

Cons:

- Budgeting can be tricky in months with three pay periods.

- It may confuse employees used to monthly or semi-monthly pay.

4. Semi-Monthly Pay Cycle

Employees are paid twice a month—usually on the 1st and 15th or 15th and last day.

Pros:

- Great for salaried workers.

- Simplifies tax withholdings and benefits tracking.

Cons:

- Overtime is harder to calculate as workweeks may overlap.

- Some states restrict semi-monthly pay for hourly workers.

5. Monthly Pay Cycle

Here, pay is processed once a month, 12 pay periods per year.

Pros:

- Easiest for budgeting and managing benefits.

- Suitable for salaried employees with fixed pay.

Cons:

- Not ideal for hourly staff.

- Some states prohibit this structure for non-exempt employees.

6. Fixed-Length Pay Cycle

Common in education or seasonal industries. Employees may be paid over a specific term, like 10 months, with the option to spread payments.

Pros:

- Aligns with seasonal work schedules.

- Offers flexibility in structuring annual salary.

Cons:

- Requires detailed planning to avoid payment gaps.

7. Custom Pay Cycle

These are non-standard, used in unique situations like final paychecks after resignation.

Pros:

- Ensures timely compliance during off-cycle events.

- Can improve the offboarding experience.

Cons:

- Varies by state law.

- Needs extra attention to avoid legal issues.

8. On-Demand Pay

This modern option lets employees withdraw earned wages anytime before payday.

Pros:

- Reduces financial stress and boosts satisfaction.

- Helps companies attract and retain top talent.

Cons:

- Needs secure, real-time tracking of what is pay period hours.

- Must integrate with existing payroll systems.

Understanding what is a pay cycle helps businesses streamline payroll and build employee trust. Choosing the right structure is about more than preference—it’s about creating a system that works for everyone.

Read More:

The Undeniable Link Between Overtime Pay And Equalization

Why Semi Monthly Pay Is Becoming Popular Among Employers

What Is Biweekly Pay & How To Calculate It In 2025?

Tips to Determine Pay Periods for Your Company

Choosing the right pay period can make or break your payroll process. It’s more than just setting a date—it’s about compliance, efficiency, and keeping your team happy.

When figuring out what is a pay cycle for your business and how to select the one that best fits, you’re taking an important step. Let’s break it down with simple, actionable tips.

1. Understand What Is a Pay Cycle

As discussed, your pay cycle plays a key role in shaping your payroll strategy. At this point, focus less on the definition and more on how it aligns with your business structure. The goal is to choose a cycle that keeps operations smooth, supports employee morale, and stays compliant with legal norms.

2. Follow State and Federal Rules

Every state has its laws about pay frequency. Some require weekly pay for hourly workers; others allow monthly schedules. The Fair Labor Standards Act (FLSA) also has rules you must follow. So, before picking a cycle, check your local and federal guidelines. It’s a simple step that protects you from legal trouble down the line.

3. Align With Your Workweek

Structure your pay cycle around your company’s workweek. If your workweek starts on Monday and ends on Sunday, your pay cycle should reflect that. This makes it easier to calculate hours and overtime. It also helps your HR and accounting teams stay organized, especially when using productivity monitoring software to track hours.

4. Consider Payroll Costs

Payroll isn’t just about paying your team. It costs money to process those payments. If you’re using a third-party service, they likely charge per pay run. More frequent pay cycles (like weekly) may lead to higher costs. If budgeting is tight, a semi-monthly or monthly cycle might work better for you.

5. Overtime Factor

Do your employees work irregular hours? Then overtime matters. When deciding what is a pay cycle, choose one that makes overtime calculations easier. If your team frequently works overtime, aligning your pay period with your workweek can help avoid confusion and ensure overtime gets paid accurately and on time.

6. Think About Employee Preferences

Want happier employees? Pay them when it helps them most. Many workers prefer frequent pay because it eases their financial stress. Bi-weekly or weekly pay can lead to better job satisfaction and lower turnover. If you’re wondering what is a pay cycle that attracts top talent, the answer may lie in offering more frequent paydays.

7. Sync With Tax Withholdings

Taxes are a big part of payroll. Your chosen pay cycle affects how you withhold and report them. Choose a cycle that simplifies this process. Most payroll software—and especially those with productivity monitoring software—make tax reporting easier, even for complex structures. So, make sure your tools match your cycle.

8. Match Your Business Rhythm

If your business is seasonal, keep that in mind. During busy months, you might want more frequent pay cycles. In slower times, fewer pay dates might help you manage cash flow better. Flexibility is key here—adjust your cycle to match your business’s pace.

9. Check Your Payroll Software

Your payroll software must handle the cycle you choose. Some systems work better with weekly runs; others are optimized for monthly. If you’re also using productivity monitoring software, ensure everything integrates smoothly. The fewer manual steps you have, the fewer mistakes you’ll make.

10. Keep It Simple and Scalable

Start simple—but think ahead. What is a pay cycle without flexibility? As your business grows, your pay cycle should still work seamlessly. Make sure it’s scalable. Review your payroll process regularly and adjust when needed. The right system grows with your team and helps keep everything running smoothly.

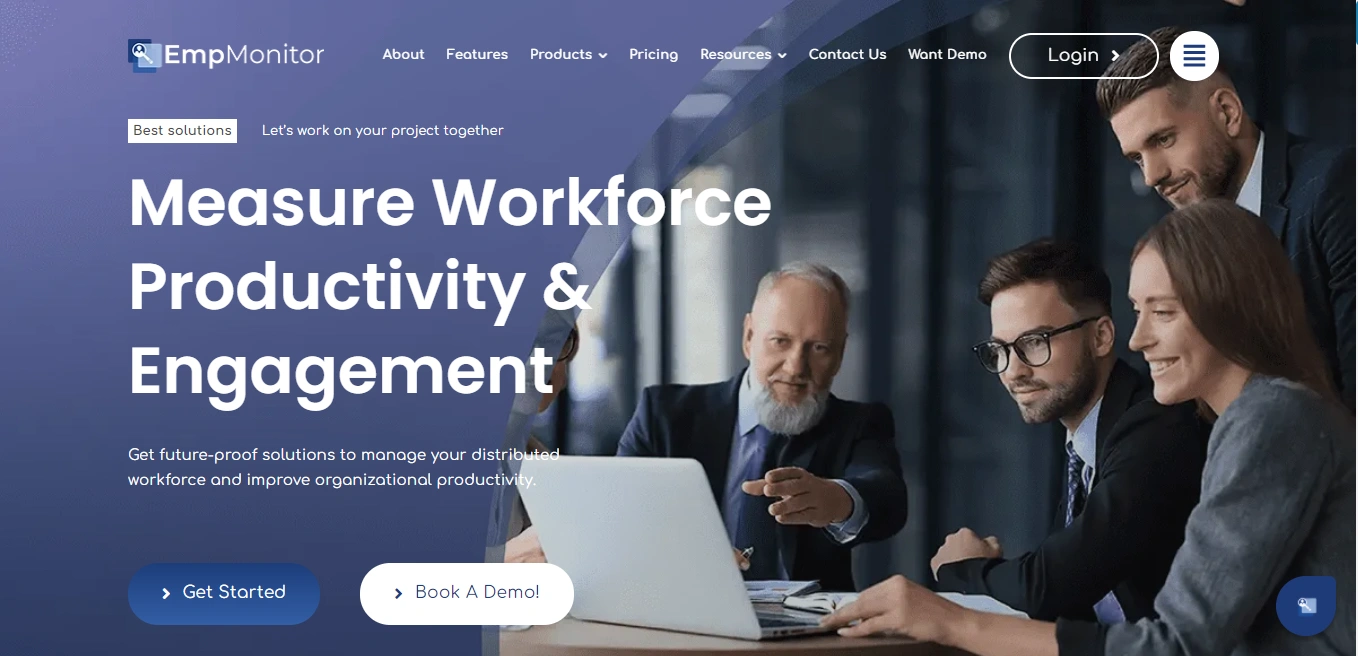

How EmpMonitor Can Help Businesses Manage Pay Cycle With Ease?

EmpMonitor is a robust employee management software that enhances workforce productivity. Trusted by over 500,000 users in more than 100 countries across various industries, it offers powerful tools for attendance tracking, shift scheduling, productivity monitoring, and payroll management, all in one place.

As you know, managing pay cycles can be tricky, but what is a pay cycle without the right tools to support it? EmpMonitor simplifies the process. With features designed for accurate attendance tracking, shift management, and payroll handling, EmpMonitor ensures every detail is managed efficiently.

Whether it’s remote teams or shift-based employees, EmpMonitor keeps everything on track, ensuring accurate and timely payments. Here’s how it can make your pay cycle management easier.

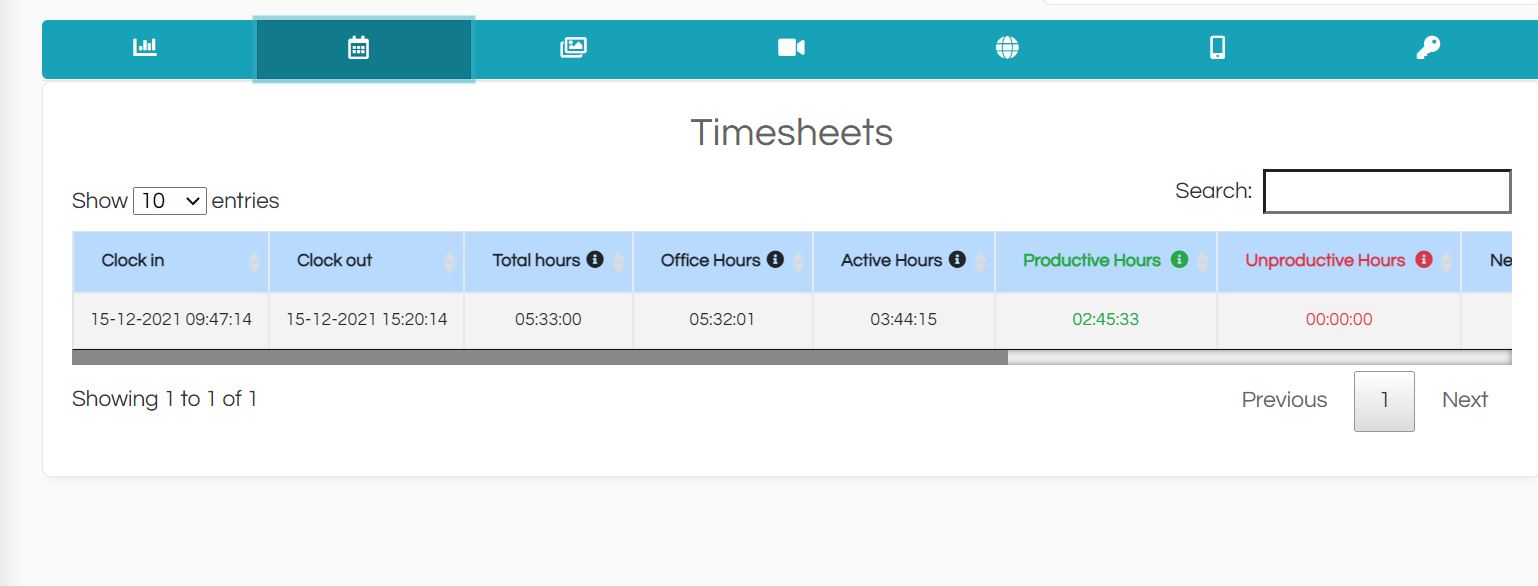

- Automated Timesheets

EmpMonitor automatically tracks employee working hours, ensuring accurate timesheet records. This eliminates errors and guarantees that employees are paid based on actual work hours, helping businesses maintain a smooth pay cycle without discrepancies.

- Attendance Management

The software offers real-time insights into employee attendance, with remote check-ins for flexibility. Whether your employees are working from the office or remotely, you can effortlessly monitor attendance, which ensures seamless integration with your pay cycle and reduces delays in payroll processing. - Shift Management

EmpMonitor’s flexible shift management allows businesses to configure shifts based on unique requirements. Whether it’s regular hours or overtime, this feature accurately logs working hours, ensuring that payroll calculations are correct and timely. - Leave Management

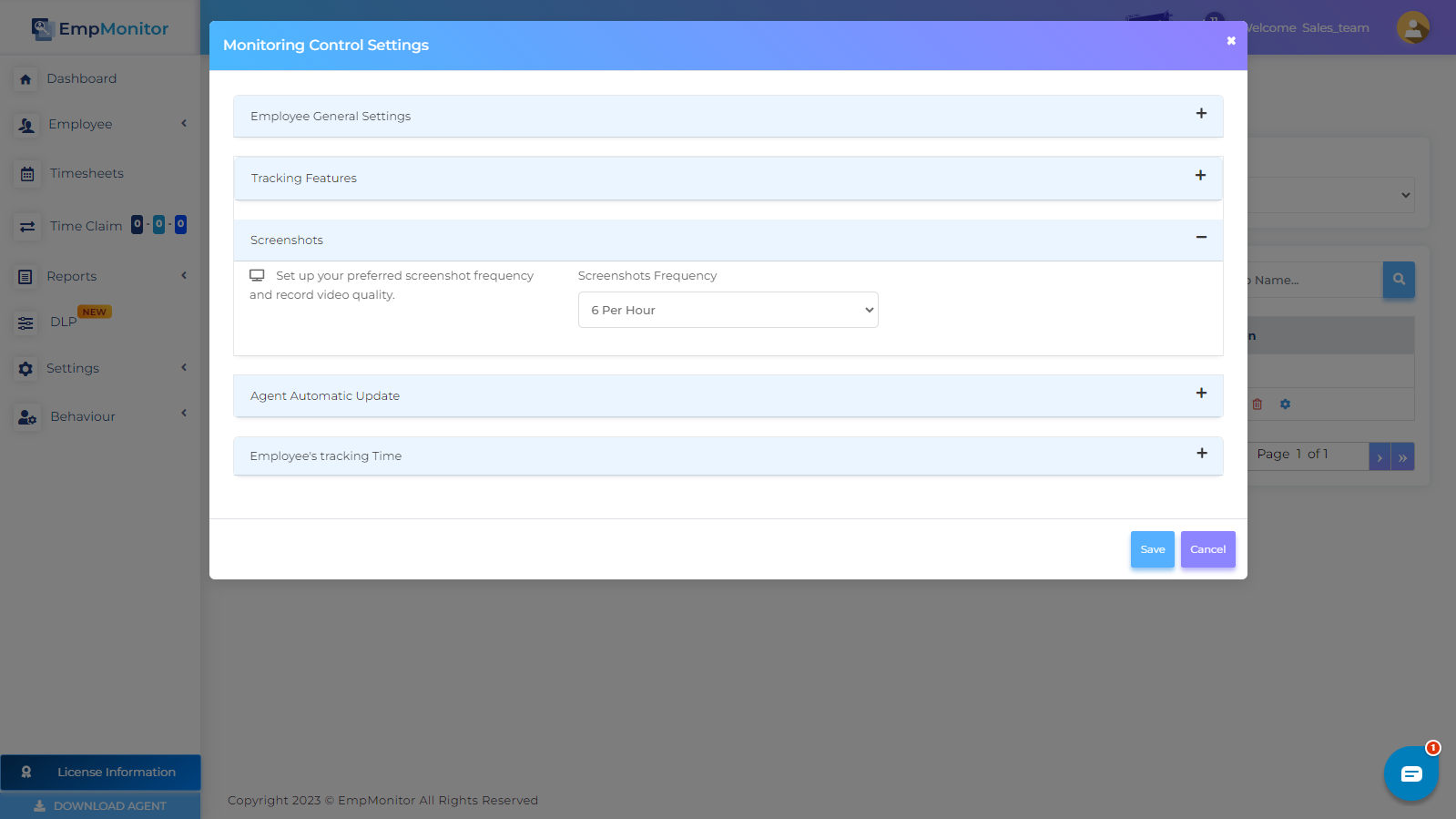

Leave requests are made simple with EmpMonitor. Employees can easily submit leave requests, and managers can approve or reject them quickly. This feature ensures that time-off is accurately calculated and integrated into the pay cycle, eliminating potential payroll errors. - Screenshot Monitoring

EmpMonitor offers screenshot monitoring, which helps businesses ensure productivity during working hours. This feature guarantees that the hours logged by employees match their actual work, helping you avoid payroll discrepancies and keeping your pay cycle on track.

By leveraging EmpMonitor’s robust features, businesses can effectively manage pay cycles, ensuring accuracy, compliance, and timely payroll processing with minimal effort.

Bottom Line

In short, understanding what is a pay cycle is crucial for smooth payroll processing. It impacts everything from compliance to employee satisfaction. The right cycle can make managing payroll much easier.

By incorporating workforce management software like EmpMonitor, you can automate attendance, track hours accurately, and streamline your entire pay cycle. No more errors, no more stress—just timely, accurate payments.

Frequently Asked Questions

How does a pay cycle differ from a pay date?

While what is a pay cycle might seem similar to a pay date, they serve different purposes. A pay cycle refers to the regular schedule you follow to pay employees, whereas the pay date is the actual day when employees receive their paycheck. The cycle typically ends a few days before the pay date, giving time for payroll processing. Choosing the right pay cycle ensures timely and legally compliant payments.

Can a pay cycle be customized for my business needs?

Yes, you can customize a pay cycle based on your business’s unique requirements. For example, you might choose to pay employees weekly, bi-weekly, or monthly. It’s essential to understand what is a pay cycle is so you can structure it in a way that fits your company’s rhythm while meeting legal and operational needs.

How do pay cycles affect employee satisfaction?

Employees prefer timely and accurate payments, which is why understanding what is a pay cycle is critical for ensuring satisfaction. By selecting a pay cycle that suits your team’s needs and using workforce management software to streamline the process, you can improve morale and retention.